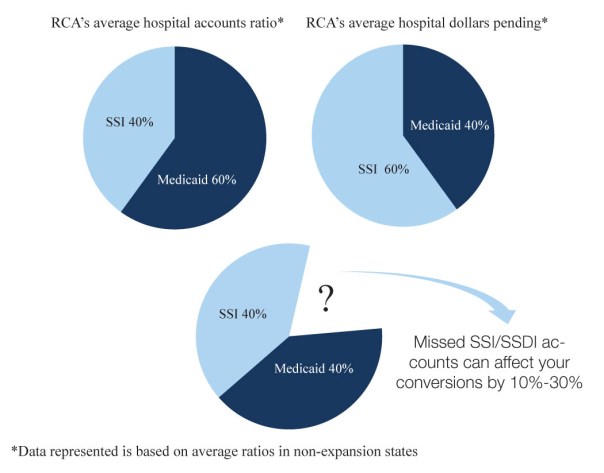

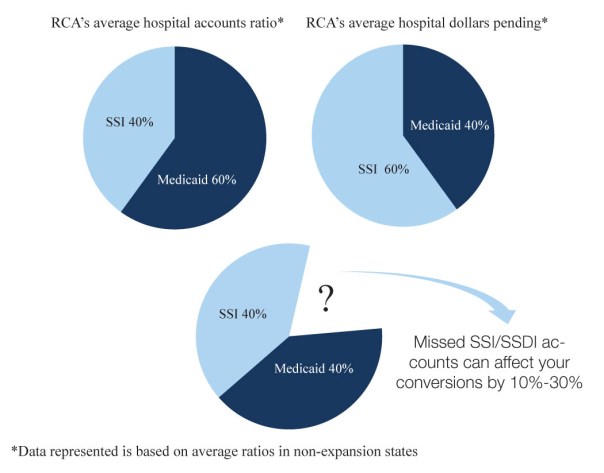

One aspect of third-party eligibility that is likely not getting enough attention from your vendor or in-house team is SSI/SSDI reimbursements. This is where we see significantly more at-risk dollars and, when followed through properly, makes up the bulk of conversions recovered for our hospital clients. Based on data we collected firsthand, while SSI/SSDI makes up only about 20-40% of self-pay inventory it averages a whopping 60%-80% of pending dollars, on average. Note that while Medicaid accounts are expected to decrease in expansion states, SSI/SSDI is still an important piece of the overall puzzle, no matter expansion or non expansion. We use those averages as a starting point when we are asked to conduct eligibility performance evaluations.

Our S.O.A.R. (SSI/SSDI Outreach and Recovery) certified experts have over 22 years of experience handling SSI/SSDI claims. Through consulting and providing services to hundreds of providers in those two decades, we have seen that the following errors occur within the SSI process:

Not knowing where the patient is in the process – This seems silly, but it’s true. A lot of eligibility teams do not continue regular follow-up on SSI accounts. In some states, the SSI/SSDI process can take upwards of 2 years and this causes a misconception that accounts won’t progress for months at a time. However, there are many stages to the timely process and weekly or even biweekly follow-up can help hospitals know where the patient is in the process and also increase the approval odds by ensuring the Social Security Administration receives everything they have requested in a timely manner.

Returning referrals to the hospital due to outside representation – When a patient utilizes an attorney or other outside representation for help with their disability claim, it is often incorrectly assumed by the vendor that communication has been compromised and that they will not get the information they need to continue working the account. Returning those accounts negatively affects your bottom line because there are ways to help the representation and the Social Security office without compromising the patient’s relationship with their representative. Therefore our eligibility best practice rule #1 is to follow-up through reimbursement to the hospital.

Informational Claims (Dummy bills) aren’t being filed in time – Do you know your state’s Medicaid filing deadline? Some states have become savvy and will not pay SSI/SSDI cases if they never receive the bill or an application to protect the dates of service. Your team should be submitting timely claims in order to protect all dates of service for the patient and then rigorously following the account so the hospital can collect in the instance a patient is approved for Medicaid during the SSI/SSDI process. Accounts not filed in time or only sent through a batch filing software could be easily lost forever.

Stopping at mediocre – Often times our SSI/SSDI cases need a little extra attention. This means immediately filing appeals, providing patient transportation to doctors’ visits, regular physician follow-up and obtaining medical records. These value-added services reap big rewards when it comes to shortening A/R days.

Bethany Bailey

Vice President and Eligibility Expert

Every provider across the country knows the time consuming pain that is dealing with Workers’ Compensation claims. Here are the top 3 issues we hear providers say they are having with Workers’ Compensation claims:

Every provider across the country knows the time consuming pain that is dealing with Workers’ Compensation claims. Here are the top 3 issues we hear providers say they are having with Workers’ Compensation claims:

Promptness of Inpatient screening – It is easy to assume the patient is being screened for government assistance before they leave the facility, but unfortunately that is not always the case. This is the first place our experts evaluate. To make a quick determination and build a relationship with the patient, your eligibility team needs to be doing screenings within 24 hours of admission.

Promptness of Inpatient screening – It is easy to assume the patient is being screened for government assistance before they leave the facility, but unfortunately that is not always the case. This is the first place our experts evaluate. To make a quick determination and build a relationship with the patient, your eligibility team needs to be doing screenings within 24 hours of admission.